In online payment process, merchants (seller) receive payments via the Internet or in situations when a payment is not physically presented to the merchant by the customer (buyer) at the time of the transaction.

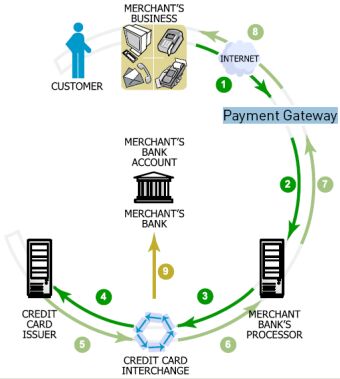

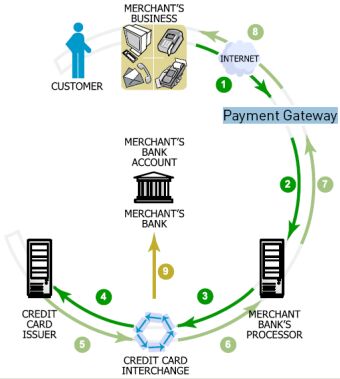

The diagram below illustrates the flow of payment information and funds from a merchant’s Web site to their bank account (i.e. merchant bank account).

The following steps explain how funds are transferred to your bank account when customer pays through credit card:

A customer submits the credit card transaction to the Payment Gateway via a secure connection from your Web site.

Payment Gateway receives the secure transaction information and passes it via a secure connection to your bank’s processor (a financial partner that provides credit card processing on behalf of the credit card associations, for example, Visa or Master Card).

Your bank’s processor submits the transaction to the Credit Card Interchange (a network of financial entities that communicate to manage the processing, clearing, and settlement of credit card transactions).

The Credit Card Interchange routes the transaction to your customer’s Credit Card Issuer.

The Credit Card Issuer approves or declines the transaction based on the customer’s available funds and passes the transaction results, and if approved, the appropriate funds, back through the Credit Card Interchange.

The Credit Card Interchange relays the transaction results to your bank’s processor.

Your bank’s processor relays the transaction results to the Payment Gateway.

Payment Gateway stores the transaction results and sends them to you and/or your customer.

The Credit Card Interchange passes the appropriate funds for the transaction to your bank, which then deposits funds into your merchant bank account.